Several businesses are attempting to restore the United States' rare earth minerals and metals industry, as the federal government seeks to reduce its dependence on China, the world's leading miner, processor and exporter of the materials.

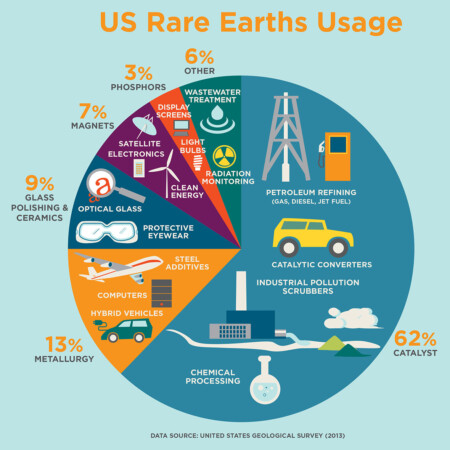

Why it matters: Rare earth minerals and metals are used in commercial electronics and military equipment, and the industry's revival comes amid escalating tensions between the U.S. and China over the coronavirus pandemic, the ongoing trade war and cyber espionage.

- The U.S. imported 80% of its rare earth supplies from China between 2015 and 2018, according to the United States Geological Survey.

- The U.S. was once self-reliant for its rare earth supply, which has gradually declined from increasing foreign competition, primarily from China, according to the Commerce Department.

The backdrop: The U.S. Army drafted plans to establish a domestic supply by funding mines and processing plants after China threatened to stop exporting rare earths to the U.S. in 2019 in response to the Trump administration blacklisting tech company Huawei.

- The Army said it will fund up to two-thirds of a refiner’s cost to build a rare earth production plant and that it would fund at least one project, though it did not specify the amount.

Zoom in: Texas Mineral Resources Corp. partnered with USA Rare Earth to build the Round Top rare earth mine in western Texas. They hope to have it operational by 2023 and are building a plant in Colorado to process the minerals, Reuters reports.

- San Antonio chemical company Blue Line Corp. in 2019 agreed to build rare earth processing plants in Texas with Australia-based Lynas, the largest producer of rare earths outside China. Both companies received approval for Pentagon funding for the project.

- MP Materials, which owns California’s Mountain Pass mine — the only rare earth mine in the U.S. — is spending $200 million to process the minerals onsite. It currently ships more than 50,000 metric tons of unrefined rare earths annually to China for processing.

By the numbers: China mined an estimated 132,000 metric tons of rare earths in 2019 and has estimated reserves of 44 million metric tons, according to USGS.

- The U.S., the world's second-largest producer, mined only 26,000 metric tons of rare earths and has 1.4 million metric tons in reserves.

What's next: Sen. Ted Cruz (R-Texas) introduced legislation earlier this month that, if approved, would give tax breaks for rare earth mine developers and manufacturers who buy their products, according to Bloomberg.

- China agreed to buy two types of rare earth metals from the United States as part of the "phase one" trade agreement signed by both countries in January, though the coronavirus pandemic may hinder China's ability to meet the terms of the deal.

- President Trump said in a press conference last week that his administration is "not interested" in renegotiating the terms of the phase one agreement.

The original Atyicle can be found @AXIOS

Leave a Reply